Corton Enhanced Income Fund

Access to investment grade floating rate collateralized loan obligations (CLOs) in a liquid and transparent ETF.

Overview

Compelling Yield

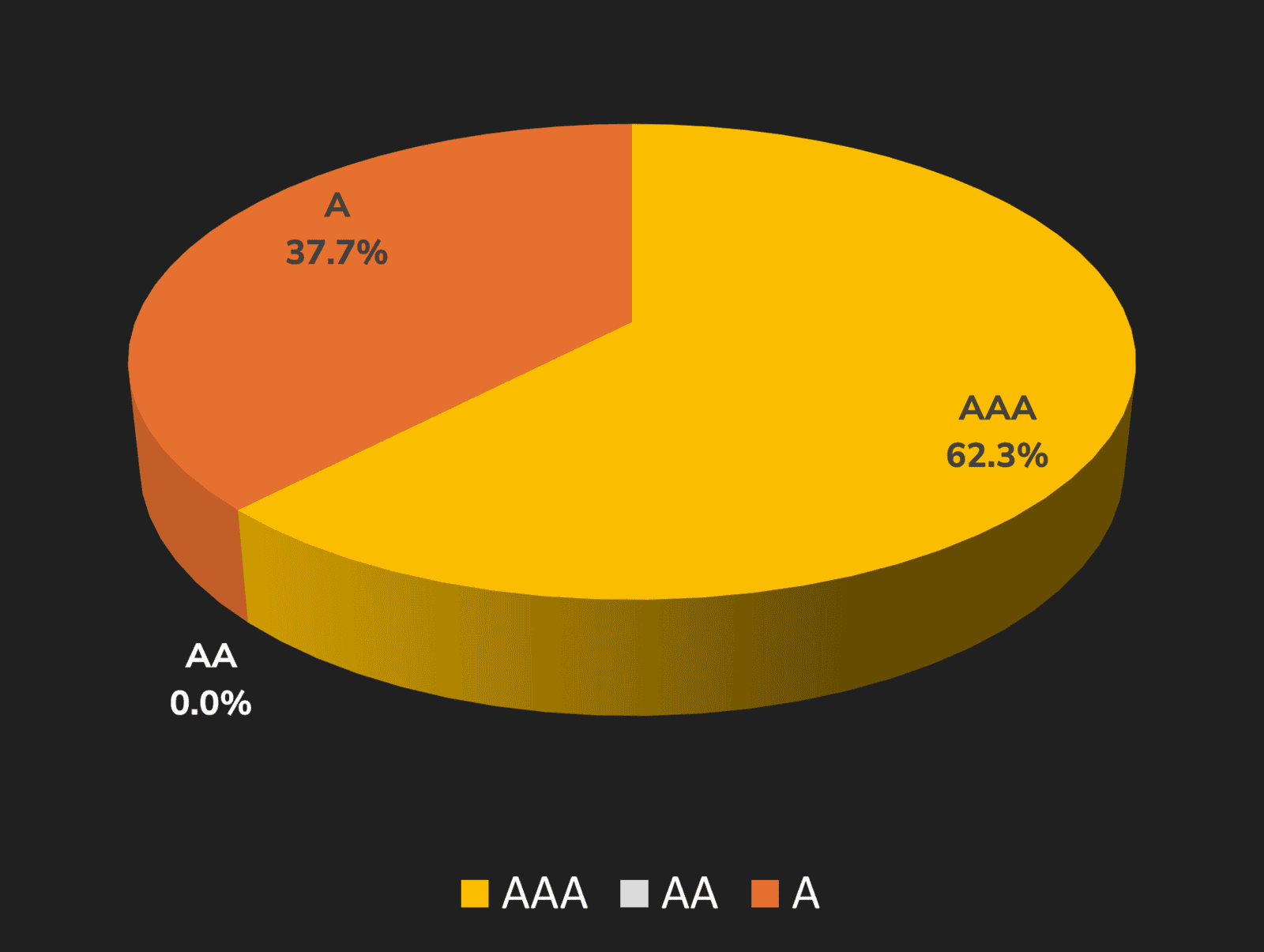

RAAA provides access to predominately AAA as well as AA and A-rated Collateralized Loan Obligations ("CLOs"). These securities have traditionally been only available to institutional investors and may offer attractive yield and diversification advantages relatively to other cash replacement and fixed income options.

Maintain Purchasing Power

The floating rate feature of CLOs will generate a higher yield when interest rates increase and a lower yield when interest rates fall, providing alignment to maintain purchasing power.

Diversification

CLOs are a unique asset class that may provide investors with enhanced portfolio diversification relative to traditional bonds.

Investment Summary

| Volatility | Low |

| Liquidity | T +1 |

| Capital Preservation | AAA - A CLOs |

| Income Generation | Variable |

| Investment Horizon | Short to Medium |

| Fees | 0.45% Annual Management Fee |

Strategy

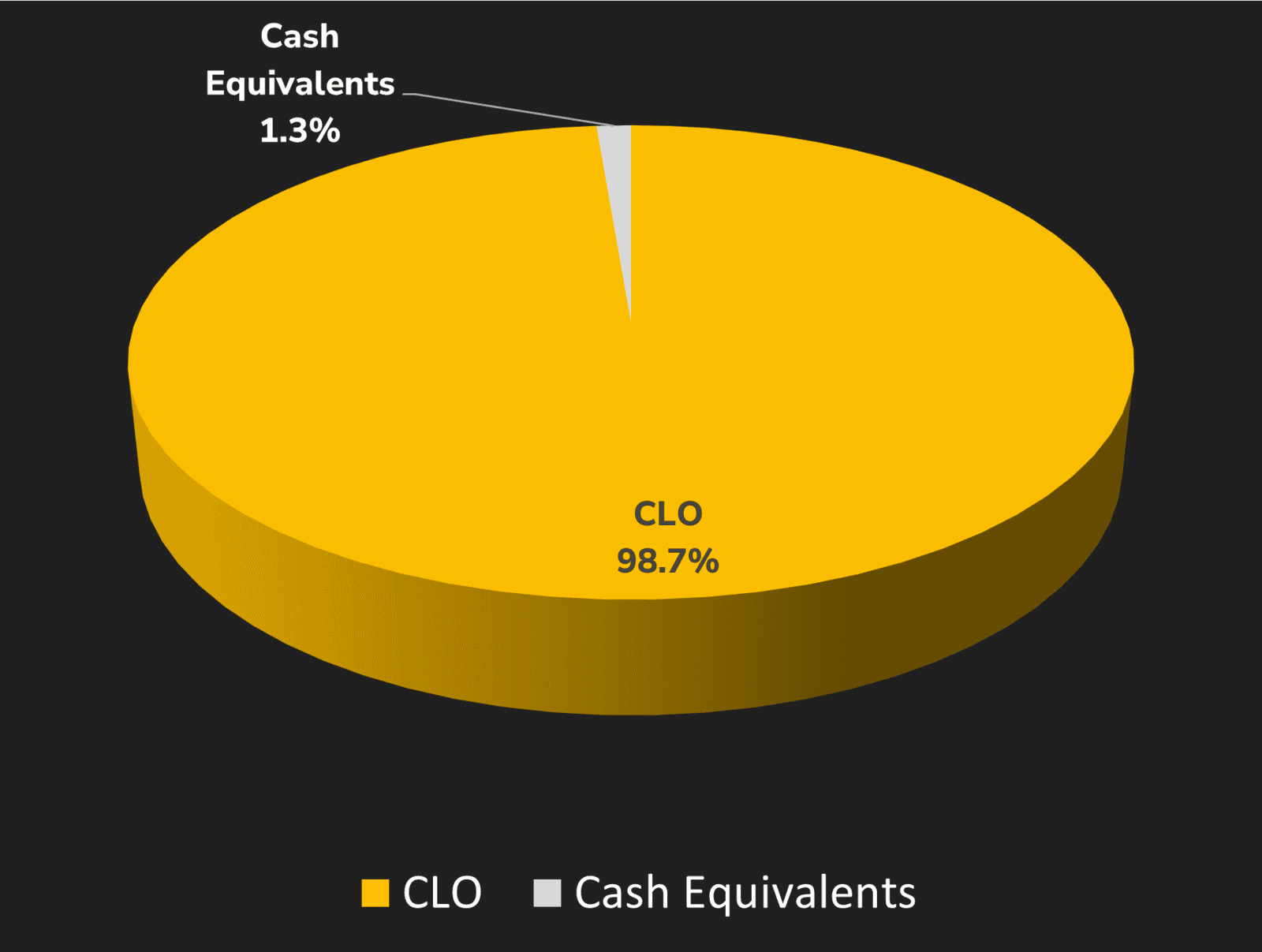

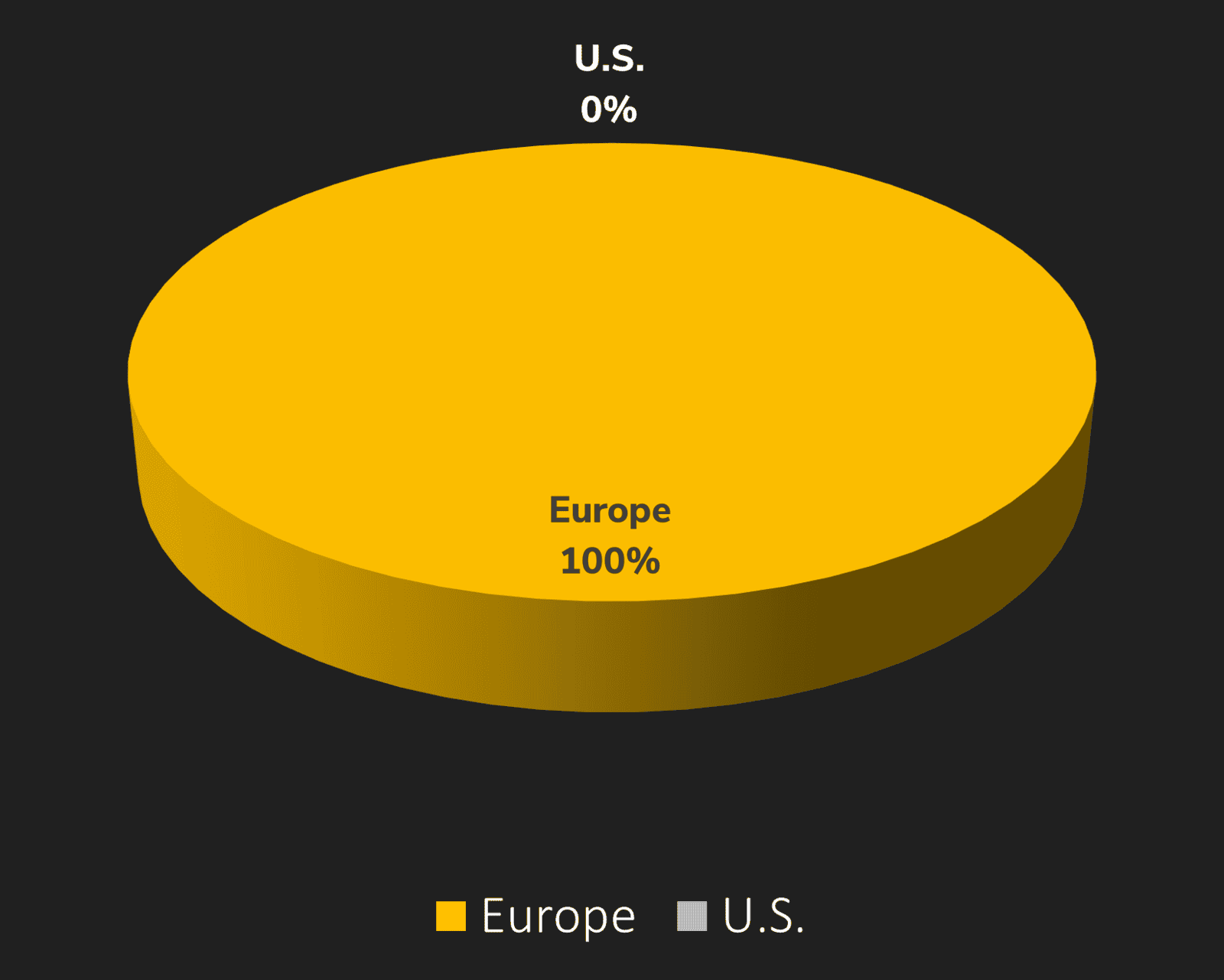

RAAA invests primarily in AAA rated securities through a diversified portfolio of European and U.S. CLOs (“collateralized loan obligations”) in both the primary and secondary markets. CLOs are primarily backed by loans that are senior in terms of priority relative to bonds and are secured by assets of the underlying obligator. The underlying securities are floating rate, includes AAA, AA and A rated, asset backed and may provide attractive yields over and above other Canadian HISA products (“high interest savings accounts”). Corton Capital Inc. has engaged Astra Asset Management UK Limited, based in London, UK, as the sub-advisor. RAAA hedges it’s returns to the Canadian dollar to reduce FX (“foreign exchange”) exposures.

Objective

RAAA seeks to provide Unitholders with a high level of current income by investing in a diversified portfolio European and U.S. floating rate primarily AAA rated collateralized loan obligations (CLOs), but may also include AA or A securities. RAAA will seek to hedge its non-Canadian dollar currency exposure at all times.

ETF Details

Eligibility

- Registered Accounts Eligible

- SWP

- PACC

Sub-Advisor

Astra Asset Management UK Ltd.

Shikha Gupta

Portfolio Manager and Investment Management Team member

Christian Adler

Co-Founder and Investment Management Team member

Summary of Investment Portfolio as at September 30, 2025

Collateralized Loan Obligations Credit Quality

Portfolio Sectors

Collateral Loan Obligations Region Allocation

Holdings | Portfolio % |

|---|---|

CVC Cordatus Loan Fund XXXII DAC, Series '32X', Class 'A' | 9.4% |

| Barings Euro CLO 2019-2 DAC, Series '2X', Class 'CR' | 8.6% |

Voya Euro CLO I DAC, Series '1X', Class 'A1R' | 8.6% |

St. Paul's Clo VII DAC, Series '7A', Class 'CRR' | 8.4% |

Sound Point Euro CLO XI Funding DAC, Series '11X', Class 'A' | 8.2% |

Adagio XII Eur Clo DAC, Series 'X', Class 'A' | 8.2% |

Jubilee CLO 2014-XII DAC | 6.9% |

DRYD 2018-66X CR 1/38 | 5.7% |

Trinitas Euro CLO VII DAC, Series '7X', Class 'A' | 5.7% |

Barings Euro CLO 2021-2 DAC, Series '2X', Class 'C' | 5.7% |

Dryden 91 Euro CLO 2021 DAC | 5.7% |

Ares European CLO XX DAC, Series '20X', Class 'A' | 5.7% |

Voya Euro CLO I DAC, Series '1X', Class 'A2R' | 3.4% |

BABSE 2021-3X C 7/34 | 3.4% |

Bain Capital Euro CLO 2019-1 DAC, Series '1X', Class 'C' | 2.1% |

Invesco Euro CLO IV DAC, Series '4X', Class 'C' | 2.0% |

Northwoods Capital 23 Euro DAC, Series '23A', Class 'C', | 1.4% |

Foreign Exchange Forward Contracts | -0.5% |

Cash and Cash Equivalents | 1.3% |

| Rec Date | Pay Date | Amount per Unit | Type |

|---|---|---|---|

| 27-Feb-2026 | 06-Mar-2026 | $0.0600 | Monthly |

| 30-Jan-2026 | 06-Feb-2026 | $0.0600 | Monthly |

| 31-Dec-2025 | 08-Jan-2026 | $0.0600 | Monthly |

| 30-Nov-2025 | 05-Dec-2025 | $0.0600 | Monthly |

| 31-Oct-2025 | 07-Nov-2025 | $0.0600 | Monthly |

| 29-Sep-2025 | 07-Oct-2025 | $0.0600 | Monthly |

| 29-Aug-2025 | 08-Sep-2025 | $0.0600 | Monthly |

| 31-Jul-2025 | 08-Aug-2025 | $0.0600 | Monthly |

| 30-Jun-2025 | 07-Jul-2025 | $0.0875 | Monthly |

| 30-May-2025 | 06-Jun-2025 | $0.0875 | Monthly |

| 30-Apr-2025 | 07-May-2025 | $0.0875 | Monthly |

| 25-Mar-2025 | 04-Apr-2025 | $0.0100 | Monthly |

| 28-Feb-2025 | 07-Mar-2025 | $0.0875 | Monthly |

| 31-Jan-2025 | 07-Feb-2025 | $0.0350 | Monthly |

| 31-Dec-2024 | 29-Jan-2025 | $0.068934 | Year End |

| Date | Title | Link |

|---|---|---|

| 20-Feb-2026 | Corton Capital Inc. Announces February 2026 Distributions for the Exchange Traded Fund | Read |

| 23-Jan-2026 | Corton Capital Inc. Announces January 2026 Distributions for the Exchange Traded Fund | Read |

| 17-Dec-2025 | Corton Capital Inc. Announces December 2025 Distributions for the Exchange Traded Fund | Read |

| 21-Nov-2025 | Corton Capital Inc. Announces November 2025 Distributions for the Exchange Traded Fund | Read |

| 30-Oct-2025 | Oct 2025 Podcast | Watch |

| 22-Oct-2025 | Corton Capital Inc. Announces October 2025 Distributions for the Exchange Traded Fund | Read |

| 22-Sep-2025 | Corton Capital Inc. Announces September 2025 Distributions for the Exchange Traded Fund | Read |

| 22-Aug-2025 | Corton Capital Inc. Announces August 2025 Distributions for the Exchange Traded Fund | Read |

| 23-Jul-2025 | Corton Capital Inc. Announces July 2025 Distributions for the Exchange Traded Fund | Read |

| 20-Jun-2025 | Corton Capital Inc. Announces June 2025 Distributions for the Exchange Traded Fund | Read |

| 23-May-2025 | Corton Capital Inc. Announces May 2025 Distributions for the Exchange Traded Fund | Read |

| 21-Apr-2025 | Corton Capital Inc. Announces April 2025 Distributions for the Exchange Traded Fund | Read |

| 28-Mar-2025 | Annual Management Report of Fund Performance - Dec 31, 2024 | Read |

| 28-Mar-2025 | Independent Review Committee (IRC) Annual Report to Securityholders - Dec 31, 2024 | Read |

| 28-Mar-2025 | Corton Enhanced Income Fund Financial Statements - Dec 31, 2024 | Read |

| 25-Mar-2025 | Corton Capital Inc. Announces March 2025 Distributions for the Exchange Traded Fund | Read |

| 20-Feb-2025 | Corton Capital Inc. Announces February 2025 Distributions for the Exchange Traded Fund | Read |

| 05-Feb-2025 | Corton Capital Inc. Announces Consolidation of Class ETF Units and Management Fee and Distribution Frequency Changes | Read |

| 23-Jan-2025 | Corton Capital Inc. Announced January 2025 Distributions for the Exchange Traded Fund | Read |

| 16-Jan-2025 | Correction Notice to Press Release Issued by Corton Capital Inc. on January 10, 2025 | Read |

| 10-Jan-2025 | Corton Capital Inc. Announces January 2025 Distributions for the Exchange Traded Fund | Read |

| 18-Sep-2024 | Corton Capital Inc. Accounces Launch of Corton Enhanced Income Fund. | Read |

Contact: ETF@CortonCapital.ca

Phone: 1 888 822 1171

<advisor information>

Commissions, management fees and expenses all may be associated with an investment in exchange-traded funds (ETFs). You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus.