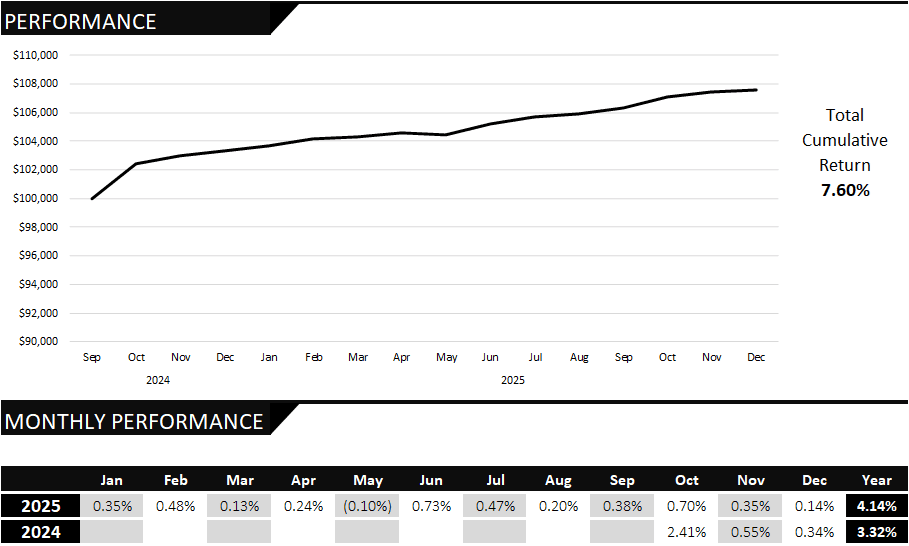

CanBridge Evercore Fund

One stop solution for alternative investments including infrastructure, private equity, private credit and real estate

Overview

The CanBridge Evercore Fund is a diversified alternative fund of funds designed to offer investors access to a portfolio of institutional-quality investments. The Fund aims to deliver attractive, risk-adjusted returns through capital appreciation and income generation by investing in sectors which have historically exhibited lower correlation to the broader equity and fixed income markets.

Investment Summary

| Target Return | 7 - 11% |

| Liquidity | 60 days notice (subject to early redemption fees in the first 3 years) |

| Minimum Investment | Class A/UA: $25,000 (registered accounts) $100,000 (non-registered accounts) |

| Investment Horizon | 3+ years |

| Fees | Class A/UA: 1.50% + 15% performance fee over 6% hurdle |

Strategy

The CanBridge Evercore Fund seeks to provide investors with exposure to the returns of the underlying CanBridge Evercore Fund Limited Partnership, which will invest in a diversified Portfolio of third-party managed investment funds and pools located primarily Canada and the United States, as well as in other jurisdictions. The underlying Portfolio is expected to invest in real assets including, but not limited to, commercial real estate and infrastructure, private equity and private debt and other asset classes. The underlying Portfolio invest in economic sectors which have historically exhibited lower correlation to the broader equity and fixed income markets.

Objective

- a “one-stop” solution for exposure to a diversified alternative investment portfolio;

- select institutional investment opportunities typically not available to individual high net worth investors;

- an opportunity for an appealing mix of asset growth and income; and

- strategic and tactical allocation changes, in response to changes in markets or economic conditions, which are generally not available to investors who invest directly in the Portfolio Investments.

| Date | Title | Link |

|---|---|---|

| 02-Feb-2026 | January 2026 Podcast | Watch |

Derek Li

Contact: derek@cortoncapital.ca

Phone: