Cormark-Corton Quantitative Opportunities Fund

Take the emotion out of investing. Long/Short variable net hedge fund utilizing systematic bottom-up and top-down quantitative models.

Overview

Strategy

Performance

Docs & News

Advisor Inquiry

Overview

Overview

Disciplined Investment StyleSystematic approach exploits the powerful momentum factor combined with fundamentals. Unique take on Momentum - measured across distinct timeframes to limit drawdowns and identify early leadership.

Consistent Returns With Downside Protection- Long / Short with high Active Share and variable net exposure

- High alpha-generating small-mid caps that investors generally overlook

- Top-down indicators take advantage of sector / factor rotation & provide risk management

Disciplined Investment Style

Systematic approach exploits the powerful momentum factor combined with fundamentals. Unique take on Momentum - measured across distinct timeframes to limit drawdowns and identify early leadership.

Consistent Returns With Downside Protection

- Long / Short with high Active Share and variable net exposure

- High alpha-generating small-mid caps that investors generally overlook

- Top-down indicators take advantage of sector / factor rotation & provide risk management

Investment Summary

| Target Return | 15+% |

| Volatility | Target beta 0 - 1.5x |

| Liquidity | Monthly |

| Capital Preservation | long-short systematically reduces beta based on top-down market indicators. |

| Income Generation | none |

| Investment Horizon | 12 - 18 months |

| Fees | Class A: 2.5% pa Class F: 1.5% pa Class I: Negotiated |

Strategy

Strategy

- Long/short with variable net exposure

- ~30 longs diversified across sectors and market cap

- 10 - 20 shorts

- Position size: long 2 - 6%, max 10%, short 2 - 5% max.

- Stop Losses systematically determined based on volatility of the stock

- Sector weights 0 - 2x benchmark, max 50%

- Max: leverage 50%, cash 50%

- Net exposure dictated by top-down models. Target Beta range 0 - 1.5x

Objective

The quant fund seeks to deliver returns in excess of the TSX Index while protecting capital during market drawdowns. The fund invests in liquid North American equities and ETFs including exposure to small-mid caps.

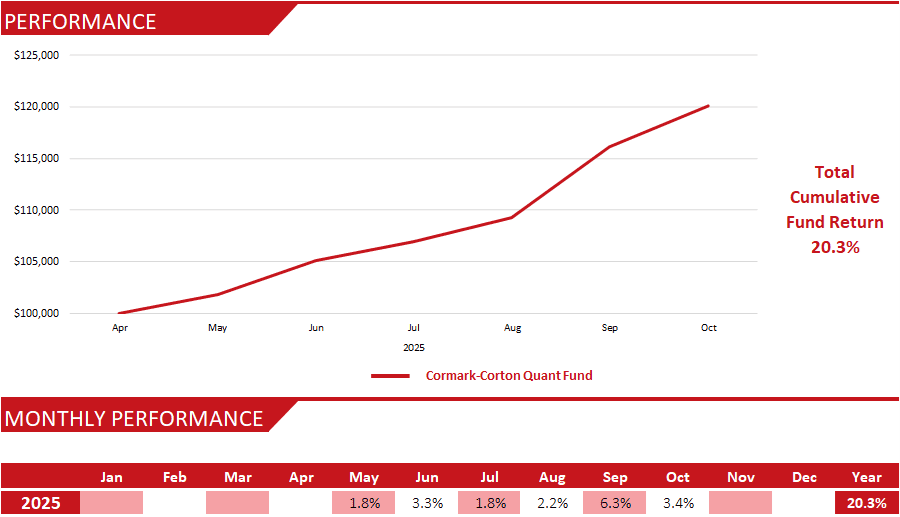

Performance

Docs & News

| Date | Title | Link |

|---|---|---|

| 09-Nov-2025 | October Monthly Update | Read |

| 07-Nov-2025 | October Podcast | Watch |

| 07-Oct-2025 | September Podcast | Watch |

| 17-Sep-2025 | August Podcast | Watch |

| 11-Aug-2025 | Monthly Update - July 2025 | Read |

| 05-Aug-2025 | Market Analysis Presentation - Aug 2025 | Watch |

| 05-Aug-2025 | Market Analysis Deck - Aug 2025 | Read |

| 08-Jul-2025 | Market Analysis Presentation - July 2025 | Watch |

| 08-Jul-2025 | Market Analysis Deck - July 2025 | Read |

| 08-Jul-2025 | Fund Review - June 2025 | Read |

Advisor Inquiry

David Jarvis david@cortoncapital.ca Phone: 416 627 5625 | Mark Deriet mderiet@cormark.com Phone: 416 562 2265 |

Mark Deriet, MA Econonics, CFA, CMT

|