Relevance Diversified Credit Fund

Focus on mis-priced credit instruments to deliver performance for investors with reduced volatility

Overview

Strategy

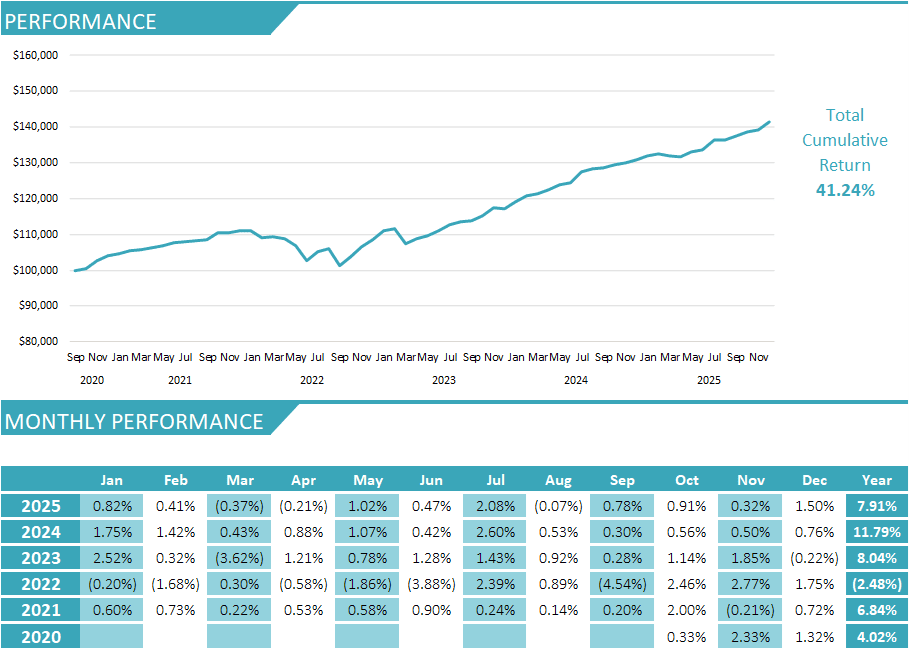

Performance

Docs & News

Advisor Inquiry

Overview

Overview

The Relevance Diversified Credit Fund primarily invests in the Astra Structured Credit Investments Ltd. (ASCIL), and may invest in other credit strategies and products. ASCIL is an opportunistic credit fund, managed by Astra Asset Management UK Limited, that identifies mis-priced fixed income securities. Because of continuing changes in the regulatory environment, unexpected credit events, and geopolitical impacts, there are continuous credit investment opportunities. Consequently, the managers do not need to generate their returns by attempting to forecast interest rates; however, the managers do exercise strict discipline thorough the analysis of risk addressing collateral, duration and legal structures.

Investment Summary

| Target Return | 6 - 8% over cash |

| Volatility | 4 - 8% |

| Liquidity | Monthly |

| Capital Preservation | Broad Credit |

| Income Generation | none |

| Investment Horizon | 1 - 10 years |

| Fees | Management Fee 1.5% Performance Fees Perf Fee <5% 0% 5% - 10% 15% >10% 20% |

Strategy

Strategy

The Relevance Diversified Credit Fund focuses on mis-priced credit instruments to deliver performance for investors with reduced volatility. Changes in the regulatory environment have resulted in imbalanced credit pricing that ranges from highly overpriced investment grade liquid instruments to deeply underpriced complex credit risk. The managers exercise strict discipline thorough the analysis of overall risk including collateral, duration and legal structure. Investors benefit from the managers in-depth expertise both in evaluating credit as well as the origination of different credit instruments.

Catalyst Driven Credit: Investments with solid credit fundamentals and an identifiable value catalyst.

Direct Origination: Bespoke lending opportunities on high value collateral assets.

Tactical Credit: Opportunistic credit trading largely driven by regulatory considerations.

Short Opportunities: Gain edge through thorough analysis of credit fundamentals and fair value

Objective

An absolute return strategy that invests with the goals of capital preservation, achieving a return of 6-8% over cash and generating consistent benchmark relative alpha.

Performance

Docs & News

| Date | Title | Link |

|---|---|---|

| 18-Oct-2025 | October Podcast | Watch |

Advisor Inquiry

Contact: keith@cortoncapital.ca

Phone: 647 283 5650

Keith Pangretitsch, CFA has 25 years’ experience in the asset management business. Prior to creating Relevance Wealth Management, Keith was Managing Director of Russell Investments Canada Ltd.’s $12B Canadian Private Client business. In this role Keith was responsible for the overall profitability of the business, including strategy, sales and marketing. Keith was also a member of the executive team of Russell Investments Canada Ltd.

Keith is a member of the Toronto Society of Financial Analysts where he is a past chair, vice chair and member of the Private Client Committee. Keith is a contributing author to advisor.ca, Investment Executive, Wealth Professional and other publications on the topic of investing and business management.