Unlocking undervalued opportunities

Overview

Strategy

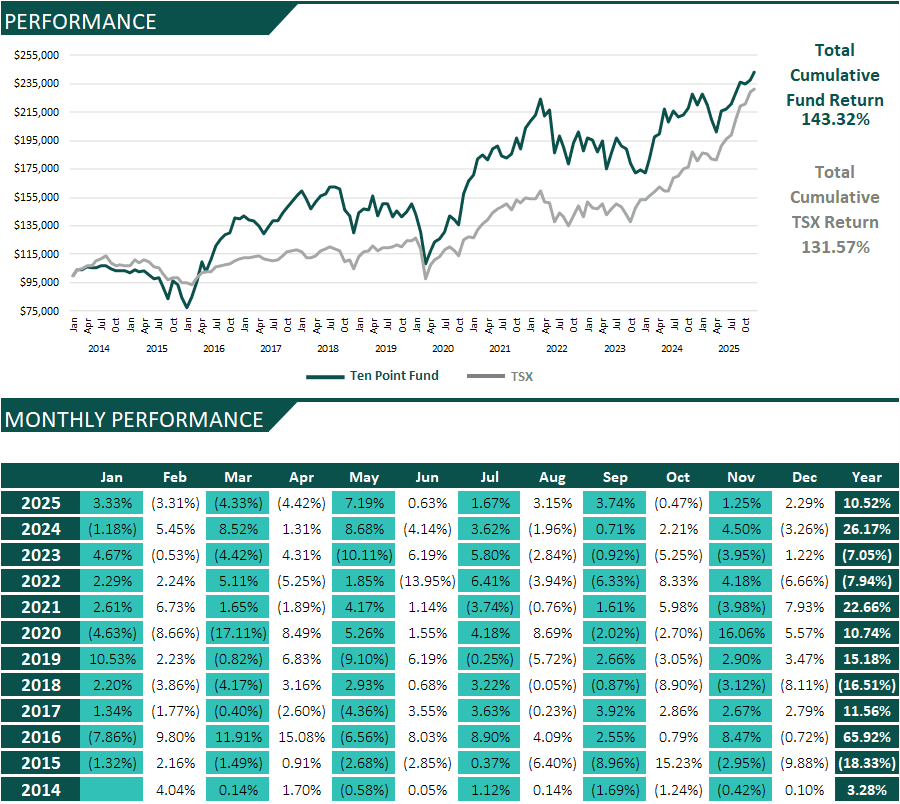

Performance

Docs & News

Advisor Inquiry

Overview

Overview

TENPOINT Fund is North American-focused, committed to delivering consistent double-digit annualized returns over a rolling 3-to-5-year period while safeguarding capital. Engineered to capture value, the fund manager diligently identifies fundamentally undervalued or mispriced securities across a broad spectrum of industries. By employing a flexible, opportunistic approach that adapts to evolving market conditions, TENPOINT Fund capitalizes on market inefficiencies as they emerge. With an unwavering commitment to objective analysis and continuous innovation, the team seizes every opportunity to unlock hidden value and drive sustainable growth.

Investment Summary

| Target Return | 10+% |

| Volatility | 10-20% |

| Liquidity | Monthly |

| Capital Preservation | Stocks |

| Income Generation | none |

| Investment Horizon | 3 - 10 years |

| Fees | 2% management fee 15% performance fee with HWM |

Strategy

Strategy

Fundamental Value

Analyzing companies’ financial health, competitive position, and intrinsic factors to identify stocks trading at a discount to their true worth

Relative ValueComparing similar companies within the same industry to identify those trading at a discount to their peers

Deep ValueTargeting severely undervalued or distressed assets with significant potential for recovery

Special SituationsInvesting in companies undergoing corporate events like mergers, spinoffs, or restructurings that may create mispriced opportunities

Analyzing companies’ financial health, competitive position, and intrinsic factors to identify stocks trading at a discount to their true worth

Relative Value

Comparing similar companies within the same industry to identify those trading at a discount to their peers

Deep Value

Targeting severely undervalued or distressed assets with significant potential for recovery

Special Situations

Investing in companies undergoing corporate events like mergers, spinoffs, or restructurings that may create mispriced opportunities

Objective

TENPOINT Fund’s investment objective is to generate double-digit annualized returns over a rolling 3-to-5-year period while preserving capital. The Fund seeks to achieve this objective by identifying fundamentally undervalued or mispriced securities. TENPOINT is a North American-focused, sector-agnostic fund, making opportunistic investments across the economy and with a variety of time horizons. The aim of the investment team is to maintain objectivity and remain open to new ideas and a changing economic environment.

Performance

Docs & News

| Date | Title | Link |

|---|---|---|

| no news |

Advisor Inquiry

Portfolio Manager: Greg Scholfield, CFA

Contact: greg@cortoncapital.ca

Phone: 647 542 1031

Greg Scholfield, CFA

Greg Scholfield has been a key player in the investment management field since 2014, gaining expertise in strategy, trading, and portfolio management. As a former strategist and trader at Spartan Fund Management, Greg transitioned to portfolio manager roles, where he demonstrated exceptional skills in aligning client goals with market opportunities. His background in property, casualty, and disability insurance further enhances his comprehensive understanding of financial services.